Leading the change towards sustainable finance

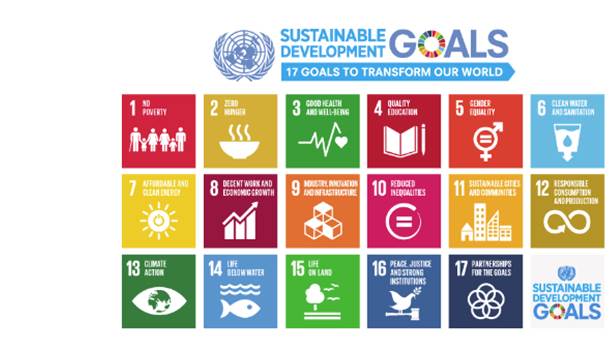

In 2015, the United Nations General Assembly put a new framework for sustainable development on the table: the 2030 Agenda for Sustainable Development, the core of which are the Sustainable Development Goals (SDGs) that are the basis for the transition to a decarbonized, more sustainable, resource-efficient, and circular economy.

Ensuring the long-term competitiveness of our economies is critical. Along these lines, the Paris Agreement also reinforces this response to climate change by ensuring, among other things, that financial flows are consistent with these claims.

We are convinced that these ideas are the way to a better future. That is why Andbank Luxembourg is adopting measures in this direction, aligning ourselves with the trends related to sustainability.

Disclosing information to end-investors on these issues is an essential part of our commitment (Regulation 2019/2088 EU or Disclosure Regulation). Reporting on the integration of sustainability risks, the analysis of adverse sustainability impacts, sustainable investment objectives or the promotion of environmental or social features has become a purpose to pursue in our business strategy and investment decision-making.

At Andbank Luxembourg, the integration of ESG criteria is considered a complementary tool to traditional financial analysis, offering a greater degree of information on current and potential risks. We will focus mainly on the following actions:

Regarding the integration of extra-financial ESG factors (environmental, social and governance), we would like to point out that:

The integration of ESG criteria is logically carried out in conjunction with financial criteria to assess the suitability of the investment. All investment approaches (qualitative, quantitative, technical) are understood to be compatible with each other and with the ESG criteria.

By integration we mean the application of ESG criteria within the investment process. For the integration of ESG criteria we start with data provided by various external information providers.

Our discretionary management service relies on an investment method with two main pillars:

Therefore, in the provision of the investment portfolio management service, both financial and non-financial criteria will be considered, including sustainable or ESG risks, with the aim of achieving better risk management by generating long-term sustainable benefits.

Please find a link to the documents related to our ESG approach:

Contact information: